- Hits: 680

International Journal of Industrial and Manufacturing Engineering

ERP Implementation in Iran: (A Successful Experience in DGC)

World Academy of Science, Engineering and Technology - International Journal of Industrial and Manufacturing Engineering Vol:8, No:9, 2014 Rome, Italy

Abstract—Nowadays, the amounts of companies which tend to have an Enterprise Resource Planning (ERP) application are increasing. Although ERP projects are expensive, time consuming, and complex, there are some successful experiences. These days, developing countries are striving to implement ERP projects successfully; however, there are many obstacles. Therefore, these projects would be failed or partially failed. This paper concerns the implementation of a successful ERP implementation, IFS, in Iran at Dana Geophysics Company (DGC). After a short review of ERP and ERP market in Iran, we propose a three phases deployment methodology (phase 1: Preparation and Business Process Management (BPM) phase 2: implementation and phase 3: testing, golive-1 (pilot) and golive-2 (final)). Then, we present five guidelines (Project Management, Change Management, Business Process Management (BPM), Training& Knowledge Management, and Technical Management), which were chose as work streams. In this case study we present lessons learned in Project management and Business process Management.

Keywords—Business Process Management, Critical Success Factors, ERP, Project Management.

I. INTRODUCTION

ODAY, the integration of companies’ business processes is, if not a necessity, a requirement linked to the reactivity imperative. Organizations ‘zeal to adopt integrated ERP systems is thus highly justified because these systems are believed to dramatically improve competitiveness. [1]. Enterprise Resource Planning (ERP) is a commodity, a product in the form of computer software and a key element of an infrastructure that delivers a solution to business. [2]. ERP systems are described as computer-based information systems designed to process an organization’s transactions and facilitate integrated and real-time planning, production and customer response [3]. These systems are designed to address the problem of fragmentation as they integrate and streamline internal processes by providing a suite of software modules that cover all functional areas of a business such as financial, project, supply chain management, human resource management, customer relationship management etc. [4]. ERP is not only an information technology (IT) solution, but also a strategic business solution [5].

As an IT solution, ERP system, if implemented fully across an entire enterprise, connects various components of the enterprise through a logical transmission and sharing of data it would enable companies to make decisions efficiently. As a strategic business solution, it will greatly improve integration across functional departments, emphasize on core business processes, and enhance overall competitiveness. In implementing an ERP solution, an organization can quickly upgrade its business processes to industry standards, taking advantage of the many years of business systems reengineering and integration experience of the major ERP vendors [6]. ERP implementation should be viewed as organizational transformation, not as a large IT project with a need to devote significant resources and energy to change management [7].

ERP implementation needs too many prerequisites top management commitment, an appropriate project management plan, skillful employee, and so on. Therefore, Implementing ERP system is a complex and time consuming project. [8] However, even under ideal circumstances, ERP implementation is fraught with formidable Challenges. It is said that about 70% of ERP implementations fail to deliver anticipated benefits [9] and three quarters of these projects are unsuccessful [10], [11]. Standish Group found that 90% of ERP implementations end up late or over budget [12] In some cases, the implementation time is extended indefinitely, which has negative consequences for both the companies and the morale of their employees [13], [14]. A lot of barriers have been found as Critical Failure Factors, inappropriate change management process, a fragile project management structure. To address and avoid these obstacles in organizations implementing ERP projects, a lot of researches have been conducted. Some of them present successful case studies and lessons learned acquired, others survey failure factors in a fail ERP project. Most of these researches devoted to developed countries rather than developing countries because only 10– 15% of global ERP sales belong to developing one. [15] Nevertheless, ERP projects are dramatically increasing in these countries [16] ERP projects are different in developing and developed countries because of many factors such as organizational culture, business processes etc. [17], [18].

Iran is a developing country which ERP market is raising so fast [19]. There is a little study which has investigated ERP case studies in Iran ERP market; besides major success or failure factors in these projects are vague. [20] Too many failures or success factors have been published by literature review or interview with project managers [21]. But there are little papers which depicts successful ERP project from beginning to the end and illustrate lessons learned in developing countries, especially Iran [22]. Subsequently, this paper is undertaken to explain a successful ERP implementation in the context of Iran and categorized the lessons learned which could be vital for any ERP implementation.

In the following sections, Iran ERP market is reviewed. Then an ERP successful case study, DGC, is presented. Next, Implementation phases and project highlights are presented. Besides, key lessons learned which gathered during project are categorized and described. Finally, conclusions and implications for future research are highlighted.

II. IRAN ERP MARKET

ERP is a flourishing market in Iran. Based on a report that published in 2008, 42 vendors were active in Iran ERP market as a solution provider or implementer. 43% of these companies were agent of international and famous ERP providers and other ones were the local companies that have their own solutions [23]. The first group is vendors who present an international ERP application such as SAP, IFS, Logo Business Solutions, Dynamic, Mincom, Netsis Software, Oracle, SAGE, and 3i Info tech [20]. Although they are international and professional applications, they are not implemented in Iran as efficient as other countries because of some reasons such as: difference in organizational culture, inappropriate business processes and so on [24]. The second group is Iranian local solutions. There were more than 10 Iranian IS companies who claimed that their ERP systems in operates in the local language i.e. Persian. [5]. they can satisfy some Iranian companies’ requirements, however they have some fundamental problems. In general, Iranian developed ERP systems are designed based on the current status of organizations and not based on best practices in the industry or improved processes. Moreover, a majority of the ERP systems do not support operations and production management processes in manufacturing companies. In addition, most of the Iranian ERP systems merely support the inter-organizational processes and not intra-organizational interactions with customers and suppliers. The ERP systems also do not contain modules such as customer relationship management and supply chain management as well as inability to support the multi-languages and multi- currencies which are critical for the multinational and international companies in Iran. [25]

III. DANA GEOPHYSICS CASE STUDY

In this section, a case study conducted at DGC the implementation of ERP (IFS) is discussed. The case study starts with introducing the company and its background, presenting the company status before and after the implementation of IFS, and giving the detail methodology of the implementation of IFS in DGC. Also, lessons learned are categorized and presented.

A. Company Background

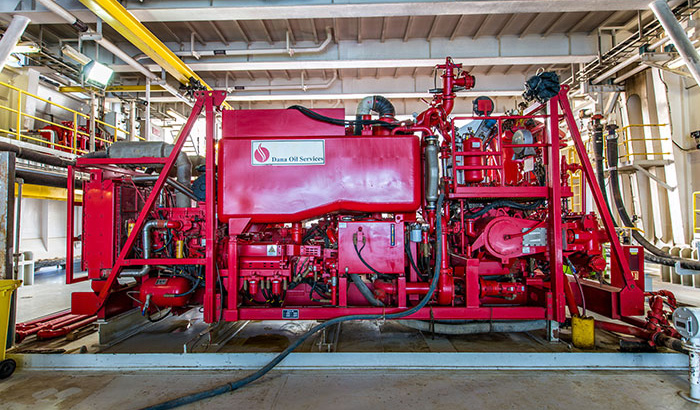

Dana Geophysics Company (DGC) is an Iranian company whose Head Office is located in Tehran, Iran. This company belongs to DANA holding, an important private company in Oil and Gas market in Iran, which his mission is to be involved in upstream sectors of Oil and Gas industry. DGC was established in 2003 with this mission “providing high standard services in geophysical seismic data acquisition, processing and interpretation for oil and gas exploration throughout IRAN and abroad”. DGC is a project based company therefore project management plays an active role in this company.

DGC main activities are Data Acquisition, Processing, and Interpretation. This company has done more than 20 Projects successfully. In 2012 DGC controlled about 80% of the market and lead the market in its field. It is major competitor is Oil Exploration Operations Company (OEOC) DGC should be agile to complete each project on time with appropriate cost, therefore integration between departments are quite necessary. Dana Holding, all branches are project base, planned to implement ERP to compete in this competitive market. After analyzing ERP applications IFS was chosen. In this time DGC has 4 data acquisition projects, Golestan, Nasr Abad, Bahar, and Bibi Hakime, also more than 5 processing and interpretation projects. Implementation of ERP, IFS, would help DGC to boost its processes and be an agile company, reducing the time delivery of goods, for example, which sometimes is a critical task in a project. An activity in a project could be stopped because lack of equipment. Says Mr. Daneshkhah, DGC CEO [42].

B. DGC Situations before ERP

DGC had used local systems, more than 30, before the project was started. These legacy systems were difficult to operate, maintain, and develop. Besides, lack of integration, for instance, between warehouses in sites and office in Tehran. Another problem was about data; DGC decided to run Knowledge Management (KM) but the problem was inadequate data and lack of flow of information. Integrity was missed between departments (for example, there was no data for Material Requisition (MR) in system and the relationship among this and Purchase Requisition or Purchase Order) and it had an adverse effect on decision-making process in DGC. These old, rigid, and not integrated systems could not help DGC to improve its business. Also, DGC is a project oriented company and project information is vital for company. (Cost control report, for instance, is one of them). Although DGC has a local cost control system, developed by DGC employee, it was not integrate to other departments and data accuracy was another problem. The last system developed in DGC was an Iranian ERP. It was used only in 2 modules, warehouse and financial, this system had following downsides.

- It has only 2 modules and could not support other functions such as procurement or project management.

- There was no integration between finance and warehouse

- Sites work offline, therefore data was not accurate

- It was a poor application in development

C. Scope of Implementation

The fundamental objective of the implementation of an ERP system at DGC was to be an agile organization, as well as integrity in all parts of organization. DGC tended to improve its supply chain management SCM) In particular, warehouses situation, each project has more than 5 warehouses. For different Goods, inventory turnover was not clear, part numbers was not clearly categorized, and there was not any connection between project activities and warehouse receipt. Therefore the costs of projects were not clear. IFS was selected as an appropriate ERP application for DGC, after searching by a team of consultants.

TABLE I

DGC SCOPE OF PROJECT

IV. HIGHLIGHTS OF DGC IMPLEMENTATION

DGC adopted a Big bang approach to ERP implementation. This approach was quite risky because it encompassed all process at the same time [26], [27] this approach was selected in order to implement in all DGC environment (office at Tehran (pilot) and then 3 operational sites out of Tehran, Nasr Abad, Bahar, Bibi Hakimeh). There is a variety of methodologies and steps which could be a guide line for an ERP project.

Accelerated SAP (ASAP), for instance, is a famous guideline for implementation created by SAP Company. Or some companies use PMBOK or other methodologies. Although all of them are helpful, it is vital to choose a guideline based on the company situations. Selecting implementation methodology and strategy plays an active role in this project [28] in the following we will explain the highlights of implementation approach.

A. Work Streams

DGC implementation team selected 5 significant elements to pursue in all steps of the project. These elements were compiled after literature review in academic and empirical studies, interview with ERP consultants in other projects in Iran. Project management, Change management, Business process management, Training and Knowledge management, and Technical management were defined in all phases of DGC project (Fig. 1).

Fig. 1 DGC project work streams

B. Project Team

In the first step, project organization team was defined with roles and responsibilities. DANA Energy is a holding company, with 9 branches, in the field of oil and gas in Iran.

Dana Geophysics Company (DGC) is one of them. Besides Dana group recruited 15 IFS expert consultants to implement and support after Go live and create a consultant team for implementation. Also a new position called ERP coordinator was added to organizational chart and an expert coordinator was hired. The head of planning department was announced as project manager he should participate in the planning project activities and manage the execution of activities according to plan. He also was responsible for managing relationships with stakeholders. ERP coordinator was assigned to all modules implementation; he was learned IFS application from technical aspect as well as best practices processes. He also should be involved in each department activities to design process map.

“He plays an important role in this project, from 7 companies involved in IFS implementation only 2 have an ERP coordinator and the results have shown that they were more successful than other companies in implementation’’ says IFS top manager in holding. Another box is Project Management Office (PMO), responsible for planning, monitoring, and reporting activities during project. Change Management Team members were CEO, ERP Project Manager, Head of HR department, and ERP coordinator. Change management plan and strategy was made by this team. Training and KM activities was planned and monitored by this team. The last box was implementation team with a matrix structure. From each department a key user was assigned by the department manager this key user should be trained for his specific module as well as his routine activities. “DGC ERP team, established in the first phase of the project, was a critical factor for a successful implementation”. (Says DGC CEO)[42] (Fig. 2).

Fig. 2 DGC IFS project team

V. THE MAJOR PHASES OF IMPLEMENTATION

This project started in12 October 2012 and ended in16 March 2014, Go Live-2 (final) phase was 2days before due date (Fig. 3). In DGC, this project was planned in 3phases, each phase includes of some steps and deliverables which considered in organizational levels, top management, business, and operation.

Fig. 3 DGC IFS project schedule

A. Phase 1

It consists of 2 main steps the first one is preparation. In this step DGC established organization project team, roles and responsibilities .the scope of project was defined and master schedule was planned. Also DGC strategy team set ERP strategies and objectives also DGC strategies were aligned with ERP strategies. Besides, the necessary infrastructures and best business practices were analyzed.

The DGC processes were evaluated for 2 reasons first, to find which processes should be modified and second to scheme DGC process map. In step 2, Business Process Management (BPM), steering committee had 2options1- change current processes and use IFS best practices 2- customizing the IFS application. The second option was chosen but some enhancement going to be done after Go live, in the second wave implementation

B. Phase 2: Implementation

It is the most important phase during project. IFS application is configured and tested in some steps. First the base line configuration was performed, tested, and approved. All development such as enterprise services, interfaces, data conversion programs, reports, and any required enhancements were built The production system is installed during realization. Besides detail schedule was made.

C. Phase 3

The final phase had 3 steps. Before Go Live all systems should work correctly, therefore, they were tested in TEMP server, there was three different servers Train, it was used to train and was sand box, TEMP, to test and confirm processes, developments, reports and so on, PROD, production server to be used after Go Live. At the end of this phase the team had to be sure there is no problem to Go Live. Detailed cut over plan was made. There was a critical obstacle; DGC office was in Tehran, Capital of Iran, and there was no problem for having IT infrastructure or recruiting capable employee, to work with IFS, but DGC had 3 projects NASR ABAD, in a desert area, Bibi Hakime, in a mountain area whit 150 KM distance from nearest city, and Bahar, in a mountain area whit 80 KM distance from nearest city, therefore there was not appropriate infrastructure such as poor Internet connection, inappropriate PCs, also the competence employee who can work with IFS was a little. The implementation team was decided to first bring Go Live at office (pilot) and enhance infrastructures and recruit competence employee for projects simultaneously. After testing, the cut over plan was run at office successfully. All paper works subsidized by IFS application, Purchase Requisition, for instance, was one of them and all process was done in IFS i.e. doing authorization, making Purchase Order (P.O), and so on. After 2 months working. With this system some gaps were identified and the consultant team solved them. But there was a highlight spot in this project which had a great risk and could fail all the system. While bringing to Go Live step in DGC sites it was crucial to Go Live happened at the same time especially in warehouse and procurement. Because sites had transactions together, particular material for example might be sent from one site to another site. So there is an approved guideline. First the financial module was brought live, although other functions worked with previous systems. The financial system is the hearth of ERP so first the financial training was dome while financial opening was made (financial basic data) after these requirements was done the financial department in projects brought Go Live they had worked for 4 weeks before warehouse face the Go Live. In this time the financial problems were solved such as lack of training, lack of authorization or access and so on. Financial coordinator plays an active role in this phase. At the same time subcontract, sales contract and project management modules were brought Go Live. The last module was warehouse. Competence employee were hired, trained and settled in sites. The point is that the warehouse goods should be counted and transported at the same time in all sites besides no transactions should be done in the time between counting and data migration in IFS, there is a fact that the work in sites are ongoing and they need goods from warehouse. All circumstances concerned and following steps were made.

- The departments requirements were gathered one day before counting

- On the special day warehouses activities were freezed.

- All warehouses were counted( it was a demanding task more than 6000 goods and all employee worked nonstop)

- After counting the list of materials were sent to financial manager to appraised the prices

- The data migration was done from office

- The previous system (Rayvarz) was stopped

- Go Live (Fig. 3)

VI. RESULTS

ERP implementation success can also be viewed from many perspectives, however the more common ones are based on two variables namely, user satisfaction and organizational impact. In DGC we consider 2 different criteria to assess the success of IFS project. In terms of project management we consider time and scope management. At the beginning of the project a time schedule was made and tracked through the project. The Go Live phase was brought 2 days before the due date (16 March 2014). From scope criteria, all objectives were achieved (Table II). From another aspect, to assess the successful of IFS project, user satisfaction was chosen. Based on the survey conducted by DGC IT department 80% announced that they fell satisfy from working with IFS application. In conclusion, consist in time, scope, and user satisfaction we called DGC IFS project successful.

TABLE II

SCOPE OF MODULES

VII. LESSONS LEARNED FROM THE IMPLEMENTATION

‘‘A well planned and well executed ERP implementation, in conjunction with a good change management program, can create a dramatic turnaround for a company [29]. The successful implementation of IFS at DGC confirms this point. Some key lessons have been learned from this project. Lessons learned were gathered, analyzed, and categorized based on work streams.

A. Project Management

Many ERP analysts have underscored the importance of project management and planning for successful implementation [22]. Project management plays a significant role in every ERP projects [30]. It also has been known as a critical failure factor (CFF) in Iran ERP market [31]. Because of the importance of project management in DGC, project management procedures, such as scope plan, time plan, cost plan, and so on, had been created before IFS project started.

B. Risk Management

One of the most important categories in project management is risk management. Risk management has been considered as a major critical success or failure factor in many academic and empirical papers [32]-[36]. The first lesson learned in DGC is: Risk management is a vital task in an ERP implementation project, especially in developing countries with turbulent circumstances. Risk management steps were done step by step by DGC PMO. The first step was to make a risk management plan. The risk management plan defines how risks are discovered, defined, assessed (during risk reviews), and managed. It also describes how often risk reviews are conducted.

Every week risk management meeting was hold with consultants, project manager, and key users from each department. Risks discovered and defined in these categories, project scope, schedule, budget, resources infrastructure, project management, change management, Business process, and technical. (Appendix 1)

C. Issue Management

ERP projects are complex and with a lot of conflicts between consultants, implementation team, and key users. Many researchers have been mentioned issues in their articles as an important part of an ERP project [33], [37]-[40]. Issues would be raised in this environment and could be barriers for the project. Therefore, they should be managed efficiently through the project. To address this problem In DGC project, an issue management plan was created. The second lesson is: issue management was a critical success factor in DGC ERP project. Issue management was done in 4 steps, issue planning, issue identification, issue handling, and issue monitoring, during the project. (Appendix 2)

D. Business Process Management

‘‘If a company rushes to install an enterprise system without first having a clear understanding of the business implications, the dream of integration can quickly turn into a nightmare’’. [23]

Business process orientation is a significant factor in an ERP project. DGC has been certified for IMS. Therefore, there was a processes orientation view in DGC.

- Business Process Re-Engineering Strategy

DGC decided to implement IFS by replacing legacy systems. There were 2 problems. First, in some processes DGC needs a quick re-engineering but it is a time consuming task, therefore, they decided to revise current DGC business process map and then decided to do re-engineering in which processes another problems would be fixed in the second wave of implementation. The second problem was, DGC wanted to implement with the minimum amount of development, because high amount of development is a major critical failure factor .The forth important lesson learned is that business process re-engineering in developing countries which has not appropriate business process should not be done suddenly, it could be done in 2 steps, first wave and second wave

- Business Process Map

A picture is worth a thousand words" while describing current organization process, called AS-IS, it is highly recommended to make a business process map. ASAP, a wellknown methodology for ERP implementation, mentions that the purpose of the business process map is to derive and agree on the scope for the start of the Business Process Management (BPM) phase. During BPM, the process map builds the foundation for the process hierarchy [41].

Fig. 4 DGC process map (level 0)

The fifth lessons learned is the importance of making an accurate and up-to date business process map from organization, especially in developing countries which a huge gap could be found between AS-IS situation and TO-BE, best practices (Fig. 4).

VIII. CONCLUSION

DGC has a large and complex business process with tremendous projects which should be done one time, with appropriate cost. Although DGC was the leader of market in Iran, they should struggle hard to compete with competitors. Also, DGC has understood that accurate information systems and direct communication with suppliers are vital when offering customers a committed promise to deliver a project. DGC decided to boost its business drastically, a project more than only an IT project. ERP IFS 7.5 was chosen to be implemented in financial, inventory, procurement, project, contracts (sub contract and sales contract), HR, payroll, and document management. DGC top management has figured out that this project would be faced with a lot of obstacles. Therefore, an implementation team was gathered. Project’s progress was monitored by Mr. Daneshkhah, CEO [42], from the start of the project to the end. There is no doubt that this top management commitment plays a significant role in success of this project. DGC implementation was done in three phases. In the first phase, the preparation of project was planned the project management was a highlight in this phase. Project management plan, training strategy, business process management road map, and master project schedule was prepared in this step. Then Business Process Management (BPM) would start the current situation and the best practices were analyzed and the gaps between them were identified. In phase 2 main configurations was done by consultants, company and sites were established, basic data was gathered, authorization rules were allocated to managers, and functional training was started. In the third phase, all transactions were tested in TEMP server, cut over plan was created. Finally, DGC brought Go Live two days before due date.

Before starting the project, five work streams were gathered by DGC team, Project management, Change management, Business process management, Training and Knowledge management, and Technical management. These work streams were highlights.

Throughout IFS project and lessons learned were categorized based on them. In project management, risk management was defined as critical success factor. Risk management plan was made and risks were managed by this procedure. Also, issues management was another major critical factor in DGC. All issues gathered, analyzed, and ranked by their priority. Then for each one, consist in their property, a solution was defined. Business process reengineering is an inevitable part of ERP projects. An accurate business process map could accelerate this re-engineering. Training strategy was a guild line made by DGC IFS team to improve training throughout project. Three levels were defined whit specific steps. In level one, in preparation, an ERP, IFS, overview was presented. In level two, in BPM, best practice processes courses were hold.

APPENDIX I

TABLE III

DGC RISK

APPENDIX II

TABLE IV

DGC ISSUE LOG

ACKNOWLEDGMENT

The author gratefully acknowledges supports from DGC CEO, Mr. Daneshkhah, and DGC IFS project manager, Mr. Ashayeri.

REFERENCES

- Al-Mashari, M., Al-Mudimigh, A. ERP implementation: Lessons from a case study. Information Technology &People 16 (1) 2003, 21–33.

- Klaus, M. Rosemann, and G. G. Gable, “What is ERP?” Information Systems Frontiers, Vol. 2, No. 2, 2000, pp.141–162.H. Poor, An Introduction to Signal Detection and Estimation. New York: SpringerVerlag, 1985, ch. 4.

- O’Leary, 2000. Enterprise Resource Planning Systems: Systems, Life Cycle, Electronic Commerce, and Risk, Cambridge University Press.

- Koch, D. Slater, E. Baatz, The ABCs of ERP, CIO, London, 2001.

- Shahin Dezdar, Sulaiman Ainin, ERP Implementation Success in Iran.

- Ifinedo, “Impacts of business vision, top management support, and external expertise on ERP success”, Business Process Management Journal, Vol. 14, No. 4, 2008, pp. 551-568.

- Al-Mashari, and M. Zairi, “Information and business process equality: The case of SAP R/3 implementation”, The Electronic Journal on Information Systems in Developing Countries, Vol. 2, No. 4, 2000, pp.1-15.

- Motwani, J., Mirchandani, D., Madan, M., Gunasekaran, A.,2002. Successful implementation of ERP projects: Evidence from two case studies. International Journal of Production Economics 75, 83–96.

- Al-Mashari, Constructs of process change management in ERP context: a focus on SAP R/3, in: Proceedings of the Sixth Americas Conference on Information Systems, Long Beach, CA, 2000.

- Kumar, B. Maheshwari, U. Kumar, An investigation of critical management issues in ERP implementation: emperical evidence from Canadian organizations, Technovation 23 (10) (2003) 793–808.

- Griffith, R. Zammuto, L. Amian- Smith, Why new technologies fail, Industrial Management (1999) 29–34.

- Hong, Y. Kim, The critical success factors for ERP implementation: an organizational fit perspective, Information & Management 40 (1) (2002) 25–40.

- Umble, E.J., Haft, R.R., Umble, M.M., 2003. Enterprise resource planning: Implementation procedures and critical success factors. European Journal of Operational Research 146, 241–257.

- Rajapakse,P.Seddon, Why ERP May not be Suitable for Organizations inDevelopingCountriesinAsia.WorkingPaperNo.121, Department of Information Systems, University of Melbourne, Melbourne, Available at:/www.pacis-net.org/file/2005/121.pdfS(accessed 28June2009),2005.

- ShahinDezdar, Sulaiman Ainin.. ERP Implementation Success in Iran, 2010.

- Molla, A. Bhalla, Business transformation through ERP: a case study of an Asian company, Journal of information technology case and application research 8 (1) (2006) 34–54.

- Soja, Difficulties in enterprise system implementation in emerging economies: insights from an exploratory study in Poland, Information Technology for Development 14 (1) (2008) 31–51.

- Huang, P. Palvia, ERP implementation issues in advanced and developing countries, Business Process Management Journal 7 (3) (2001) 276–284

- Nikookar, et al., Competitive advantage of enterprise resource planning vendors in Iran, Information Systems 35 (3) (2010) 271–277.

- Amin Amid, MortezaMoalagh, AhadZareRavasan, Identification and classification of ERP critical failure factors in Iranian industries, Information Systems 37 (2012) 227–237.

- Umble, R. Haft, M. Umble, Enterprise resource planning: implementation procedures and critical success factors, European Journal of Operational Research 146 (2) (2003) 241–257.

- W. T. Ngai, C. C. H. Law, and F. K. T. Wat, “Examining the critical success factors in the adoption of enterprise resource planning”, Computers in Industry, Vol. 59, No. 6, 2008, pp. 548-564.

- N. Taheri, H.T. Ardekani, H.K. Bagheri, Iran ERP Market

Characteristics, 195 (2008) 42–48 (In Persian).

- Amin Amid, Morteza Moalagh, AhadZare Ravasan,2011, Identification and classification of ERP critical failure factors in Iranian industries. Information Systems,37/227-237

- Nikookar, et al., Competitive advantage of enterprise resource planning vendors in Iran, Information Systems 35 (3) (2010) 271–277.

- Welti, N., 1999. Successful SAP R/3 Implementation: Practical Management of ERP Projects. Addison Wesley, Reading, MA.

- Davenport, T., 2000. Mission critical, realizing the promise of Enterprise Systems. Harvard Business School Press, Boston, A.

- Aladwani, A.M., 2001. Change management strategies for successful ERP implementation. Business Process Management Journal 7 (3), 266– 275.

- Davenport, T., 2000. Mission critical, Realizing the promise of Enterprise Systems. Harvard Business School Press, Boston, MA.

- Umble, M. Umble, Avoiding ERP implementation failure, Indus- trial Management 44 (1) (2002) 25–33.

- Davenport, T., 1998. Putting the Enterprise into the Enterprise System. Harvard Business Review 76 (July–August),121–131.

- Xue, et al., ERP implementation failures in China: case studies with implications for ERP vendors, International Journal of Production Economics 97 (3) (2005) 279–295.

- O.R. Kholeif, M. Abdel-Kader, M. Sherer, ERP customization failure: institutionalized accounting practices, power relations and market forces, Journal of Accounting & Organizational Change 3 (3) (2007) 250–269.

- Kouki, R. Pellerin, D. Poulin, An exploratory study of ERP assimilation in developing countries: the case of three Tunisian companies, in: Proceedings of the Third International Conference on Software Engineering Advances, 2008: IEEE.

- H. Tsai, et al., Investigation of ERP Implementation Problems in Organization Environment, 2009: IEEE.

- Noudoostbeni, N.M. Yasin, H.S. Jenatabadi, To investigate the success and failure factors of ERP implementation within Malaysian small and medium enterprises, in: Proceedings of the 2009 International Conference on Information Management and Engineering, 2009: IEEE.

- Barker, M.N. Frolick, ERP implementation failure: a case study, Information Systems Management 20 (4) (2003) 43–49.

- Al-Mashari, A. Al-Mudimigh, M. Zairi, Enterprise resource planning: a taxonomy of critical factors, European Journal of Operational Research 146 (2) (2003) 352–364.

- Al-Mashari, A. Al-Mudimigh, ERP implementation: lessons from a case study, Information Technology & People 16 (1) (2003) 21–33.

- Wickramasinghe, V. Gunawardena, Critical elements that dis- criminate between successful and unsuccessful ERP implementations in Sri Lanka, Journal of Enterprise Information Management 23 (4) (2010) 466–485.

- sap.com/ roadmaps/ASAP.

- Mohsen Daneshkhah, DGC CEO.

Mohammad Reza Ostad Ali Naghi Kashani